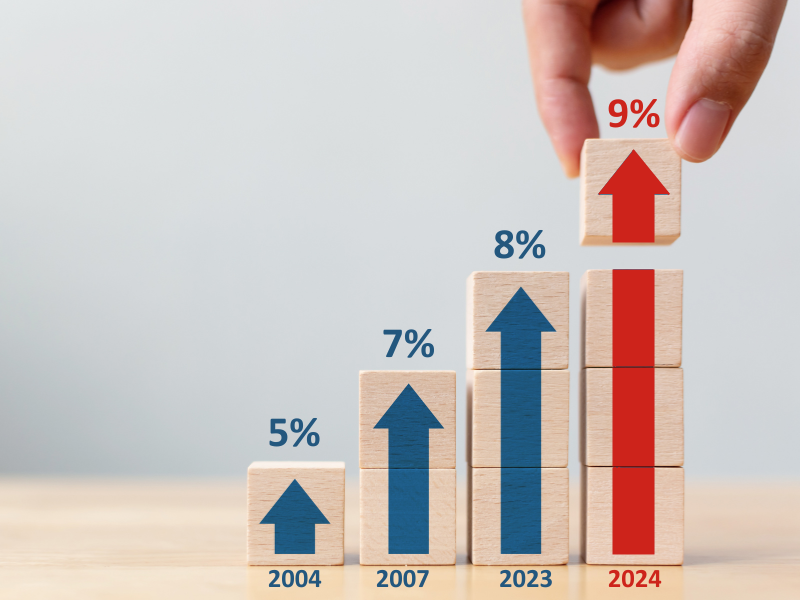

In a fresh move to ease the financial strain faced by households, the Singapore government has officially announced a Goods and Services Tax (GST) cash payout of up to $700 in 2025. This disbursement is a part of the enhanced Assurance Package, which is aimed at mitigating the effects of the recent GST hike to 9% and rising living expenses.

- Eligible citizens will receive between $200 and $700, depending on income and age.

- Payments will be disbursed in August 2025 via direct bank transfers.

- No application is required; eligible recipients will be automatically notified.

| Component | Details |

|---|---|

| Maximum Payout Amount | $700 |

| Eligibility Age | 21 years and above |

| Disbursement Month | August 2025 |

| Annual Income Threshold | Below $100,000 |

| Property Ownership Criteria | Must not own more than one property |

| Annual Value (AV) of Residence | Must not exceed $21,000 |

| Notification Channels | SMS, Singpass, or official government letters |

Purpose Behind the $700 GST Payment

The newly confirmed GST cash support comes as part of the broader strategy to reduce the burden of the GST increase introduced earlier this year. The Assurance Package, coupled with the GST Voucher (GSTV) scheme, has been structured to cushion low- and middle-income households against rising inflation. This initiative ensures that essential support continues for those most vulnerable to economic fluctuations.

Breakdown of the GST Payout Amounts

The payout amount varies across different demographic groups. Individuals’ annual income, property value, and age will determine the exact sum they receive. Senior citizens aged 55 and above with lower incomes will qualify for the maximum payout of $700. Others may receive between $200 and $500 based on their financial situation. All eligible residents will receive payment notifications and corresponding details in August 2025.

Eligibility Requirements for the 2025 GST Payout

| Annual Assessable Income | Age Group | Home Value (AV) | GST Payout Amount (2025) |

|---|---|---|---|

| Up to $34,000 | 21 – 54 | ≤ $13,000 | $450 |

| Up to $34,000 | 55 – 64 | ≤ $13,000 | $600 |

| Up to $34,000 | 65 and above | ≤ $13,000 | $700 |

| Above $34,000 | Any age | ≤ $21,000 | $250 – $350 |

| Above $34,000 | Any age | > $21,000 | Not eligible |

To benefit from this support scheme, residents must fulfill specific criteria. The eligibility rules include being a Singapore citizen, residing within the country, and being at least 21 years old by 2025. Additionally, applicants must have an annual income below $100,000 and should not own more than one property. The residential property must also have an Annual Value (AV) not exceeding $21,000. Those who do not meet these conditions will be excluded from this payout but might be eligible for other assistance initiatives.

How to Receive the GST Support Payment

Eligible individuals are not required to file any application for the GST payout. The Inland Revenue Authority of Singapore (IRAS) will directly transfer the funds into verified bank accounts. However, citizens must ensure their bank details are up-to-date on official government platforms, such as gov.sg or MyInfo through Singpass. It is essential to verify and update these details by July 31, 2025, to avoid any delays in receiving the payout.

Additional Support Under the Assurance Package

Besides the GST cash payout, the Assurance Package includes various other benefits to address inflation pressures. These consist of CDC vouchers for everyday essentials, U-Save rebates to help with utility bills, and Medisave top-ups for healthcare-related expenses. Updates on these additional benefits will be announced closer to the respective disbursement dates.

Final Thoughts

The confirmed GST payout is a critical step in the government’s ongoing mission to provide financial stability and relief to Singaporean households. With the Assurance Package offering a comprehensive blend of cash, rebates, and vouchers, residents can expect meaningful support in 2025 as the cost of living continues to pose challenges.